Projects

-

Overview & Highlights

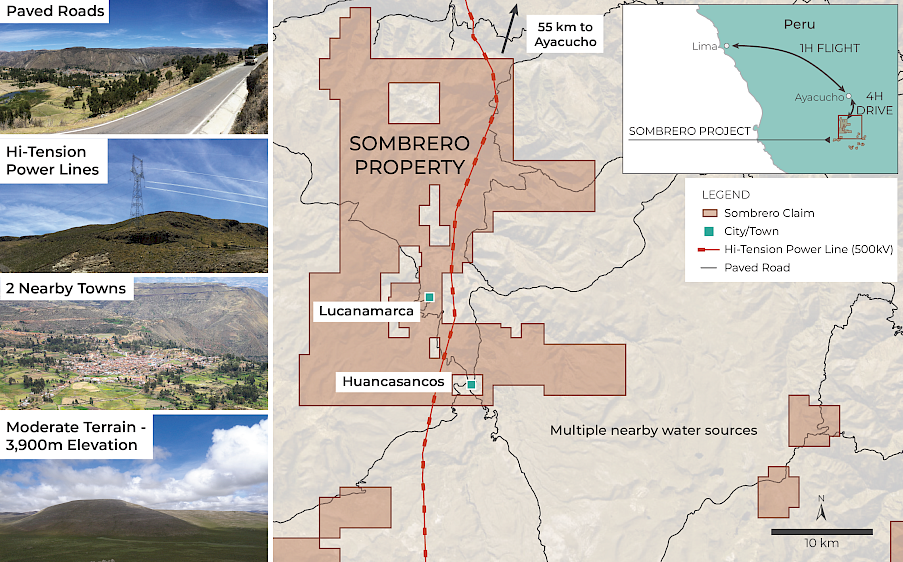

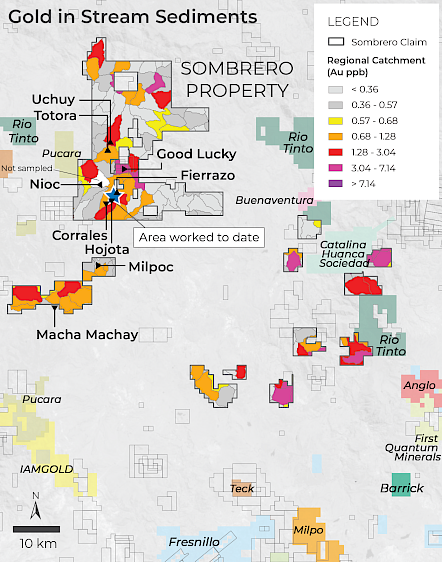

The Sombrero concessions are comprised of approximately 103,000 hectares (see Q2 2023 Management's Discussion & Analysis) located about 340 kilometres SE of Lima in southern Peru. They were screened through an extensive stream sediment program and selected due to the increased levels of overlapping copper and gold.

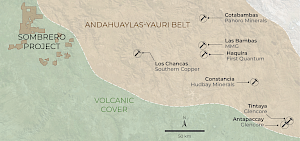

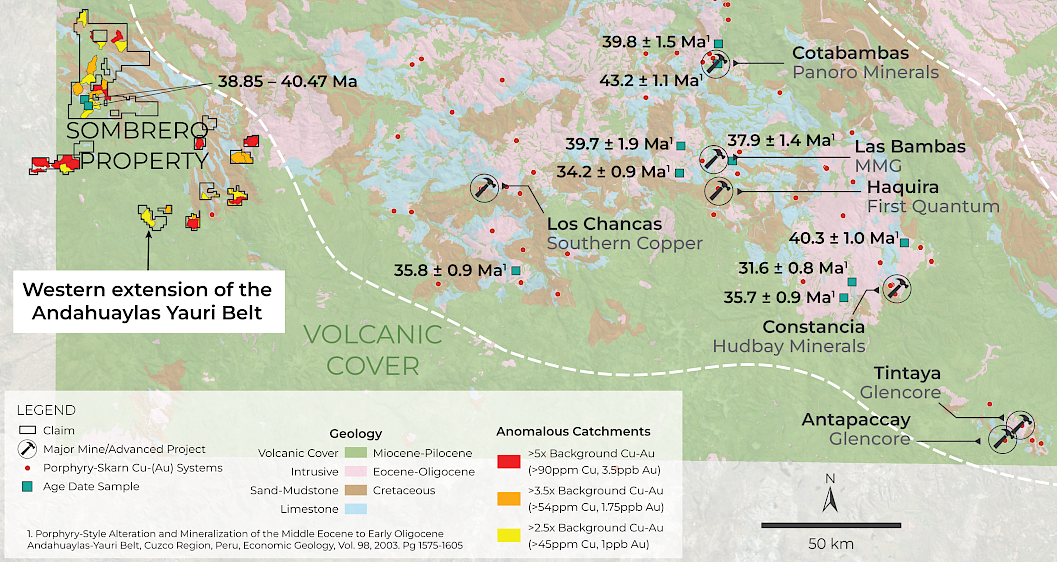

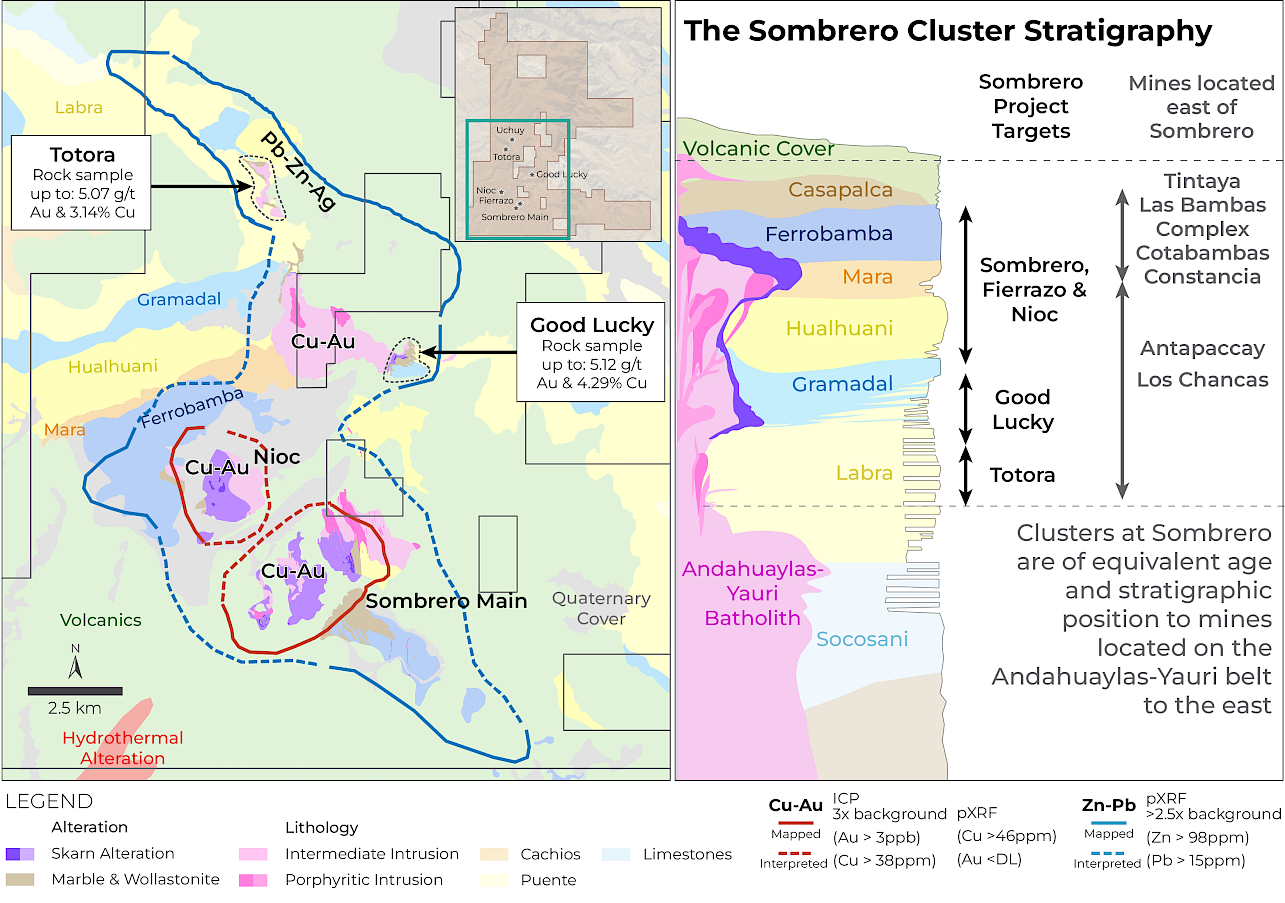

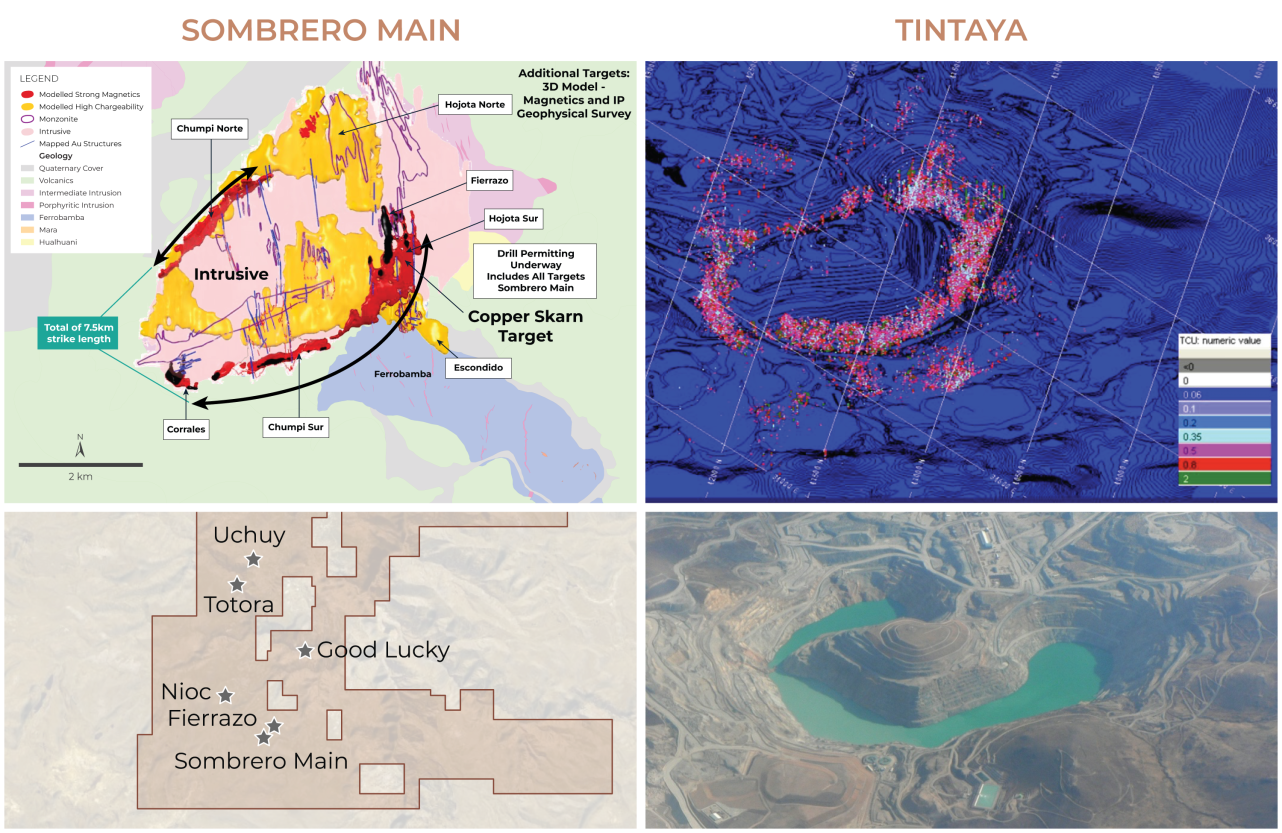

The concessions are hosted in the northwestern extension of the Andahuaylas-Yauri belt, which hosts the Eocene-Oligocene aged copper-gold porphyry and skarn Las Bambas, Haquira, Los Chancas, Cotambambas, Constancia, Antapaccay and Tintaya deposits. The Sombrero project is characterized by multiple mineralized intrusive centers with significant copper and gold values from surface samples. The principal targets at Sombrero are copper-gold skarn, porphyry systems and precious metal epithermal deposits. The Company has confirmed the mineralizing intrusives at the Ccascabamba and Nioc targets within the Sombrero project occurred within the same Eocene era as the world-class mines on the belt.

Sombrero Project Highlights:

- Multiple skarn and epithermal bodies hosted by the Ferrobamba limestone and cut by intrusives

- Major oxide targets from surface

- 3900 m elevation with excellent access to infrastructure

- Undrilled for copper and/or gold to-date

Sombrero North: 3 Mineralized Systems | 18 x 6 km Footprint & Sombrero Cluster Stratigraphy

-

Exploration

Age Dating:

The Company has confirmed that the age of the intrusives within the Sombrero district are equivalent to those of several major deposits to the east, in the Andahuaylas-Yauri belt. Based on results from five uranium-lead samples obtained from diorite sills at the Ccascabamba and Nioc targets, ages range from 38.85 to 40.47 million years. This places the mineralization within the same Eocene-aged metallogenic event that produced world-class deposits such as Las Bambas. It also establishes that the belt extends over 100 kilometres to the west, where the Sombrero project is located.

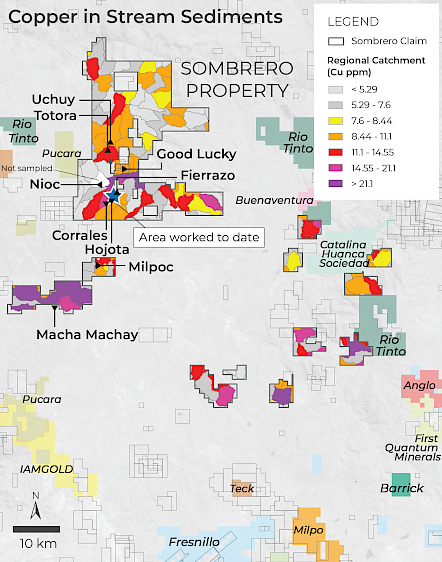

Regional Stream Sediment Survey:

Since 2017, the Company has been conducting geochemical surveys over 7000 square kilometres of land by collecting stream sediment samples from drainage basins to target potential mineralization. The results of these surveys can be seen in the maps to below, which display copper, gold and silver values over the Sombrero project area. The highest copper values in stream sediments observed were at Macha Machay, which the Company staked in 2019. The highest copper values at Macha Machay were found in consecutive drainage basins over an area of approximately 12 kilometres by 6 kilometres. Both leachable (CN44) and ICP results demonstrate copper levels 1.5-3.5 times greater than those observed at the Sombrero Main, Nioc and Good Lucky intrusive clusters, which are all characterized by high-grade copper-gold surface mineralization.

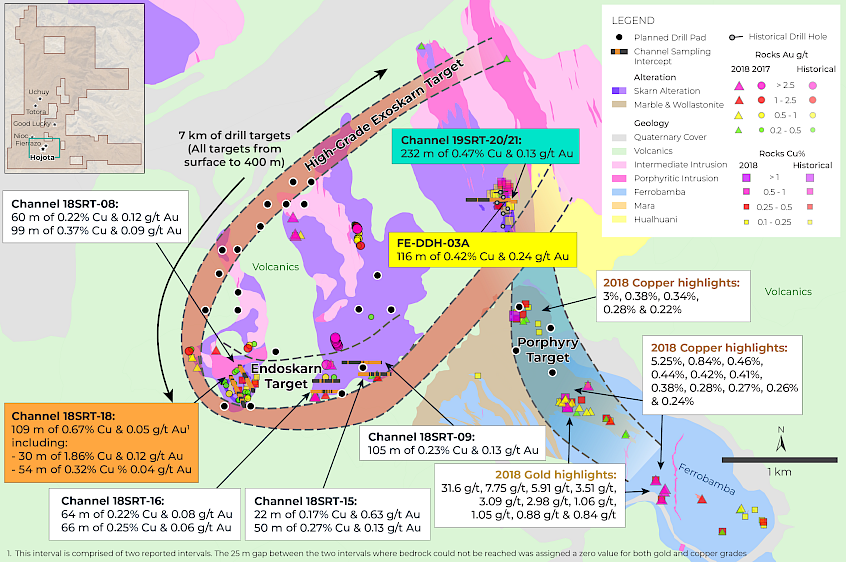

Channel Sampling:

The first channel sample of the Company's 2019 program was Channel Sample 20, in the Fierrazo concession, with 184 metres of 0.57% copper-gold equivalent, including three higher grade internal intervals of 20 metres of 1.53% copper equivalent (1.50% copper and 0.04 g/t gold), 24 metres of 0.76% copper equivalent (0.70% copper and 0.09 g/t gold) and 20 metres of 0.95% copper equivalent (0.32% copper and 0.99 g/t gold). This mineralization was then extended through continuous channel sampling by 48 metres of 0.51% copper equivalent (0.49% copper and 0.04 g/t gold), creating a combined width of 232 metres of 0.55% copper equivalent (0.47% copper and 0.13 g/t gold). This extension included a higher grade internal interval of 40 metres of 1.26% copper equivalent (1.23% copper and 0.05 g/t gold).

Channel Sample 20 is characterized by a continuous broad interval of both endoskarn and exoskarn mineralization, and extends the known copper-gold skarn mineralization to over a 3.5-kilometre strike length along the margins of the contact zone between the Ferrobamba limestone and the mineralizing intrusive.

In 2018, the Company's technical team identified Channel Sample 18, with 30 metres of 1.93% copper equivalent, 24 metres of 0.73% CuEq and 54 metres of 0.34% CuEq.

Broad zones of oxide copper and gold mineralization (endoskarn) have been encountered within a diorite-monzondiorite intrusive complex. This is peripheral to the main exoskarn target areas between the intrusive body and the Ferrobamba limestone sequence. Importantly, the endoskarn mineralization has been encountered over an approximate width of one kilometre, demonstrating the potential size of the mineralized system at Sombrero.

The encountered mineralized intervals in Channel Sample 18 are separated by an interval where the trench was unable to reach bedrock. If the intervals of copper-gold mineralization are composited together with the area where no bedrock was encountered, using values of zero for both the copper and gold grades in the unsampled part of the trench, Channel Sample 18 has a result of 109 metres at 0.7% CuEq.

Sombrero Channel Sampling 2018 – Copper & Gold Significant Intercepts*

Channel Sample From

(m)To

(m)Interval

(m)Cu

(%)Au

(g/t)CuEQ

(%)AuEQ

(g/t)18SRT-17 62 68 6 0.10 0.91 0.63 1.08 136 142 6 0.19 0.04 0.21 0.37 162 178 16 0.14 0.05 0.16 0.29 18SRT-18 14 30 16 0.47 0.10 0.53 0.92 49 79 30 1.86 0.12 1.93 3.34 79 104 not sampled bedrock not encountered 104 158 54 0.32 0.04 0.34 0.60 182 206 24 0.66 0.11 0.73 1.26 230 244 14 0.14 0.02 0.15 0.27 *No less than 5m of >= 0.1% Cu, maximum dilution 5m

Metal price used for Eq calculations: Au $1,300/oz and Cu $3.28/lb, no adjustments for metallurgical recoveries have been made.

The Company believes these trenches represent true widths of the mineralized system.Sombrero Fierrazo Concession – Copper & Gold Significant Intercepts*

Channel Sample From

(m)To

(m)Interval

(m)Cu

(%)Au

(g/t)CuEQ

(%)AuEQ

(g/t)19SRT-20 178 362 184 0.47 0.16 0.57 0.90 Incl. 178 198 20 1.50 0.04 1.53 2.41 Incl. 222 246 24 0.70 0.09 0.76 1.20 Incl. 274 294 20 0.32 0.99 0.95 1.50 464 474 10 0.22 0.02 0.23 0.37 *No less than 5m of >= 0.1% Cu, maximum dilution 6m

Metal price used for Eq calculations: Au $1,300/oz and Cu $3.00/lb, no adjustments for metallurgical recoveries have been made.Historical Drill Core:

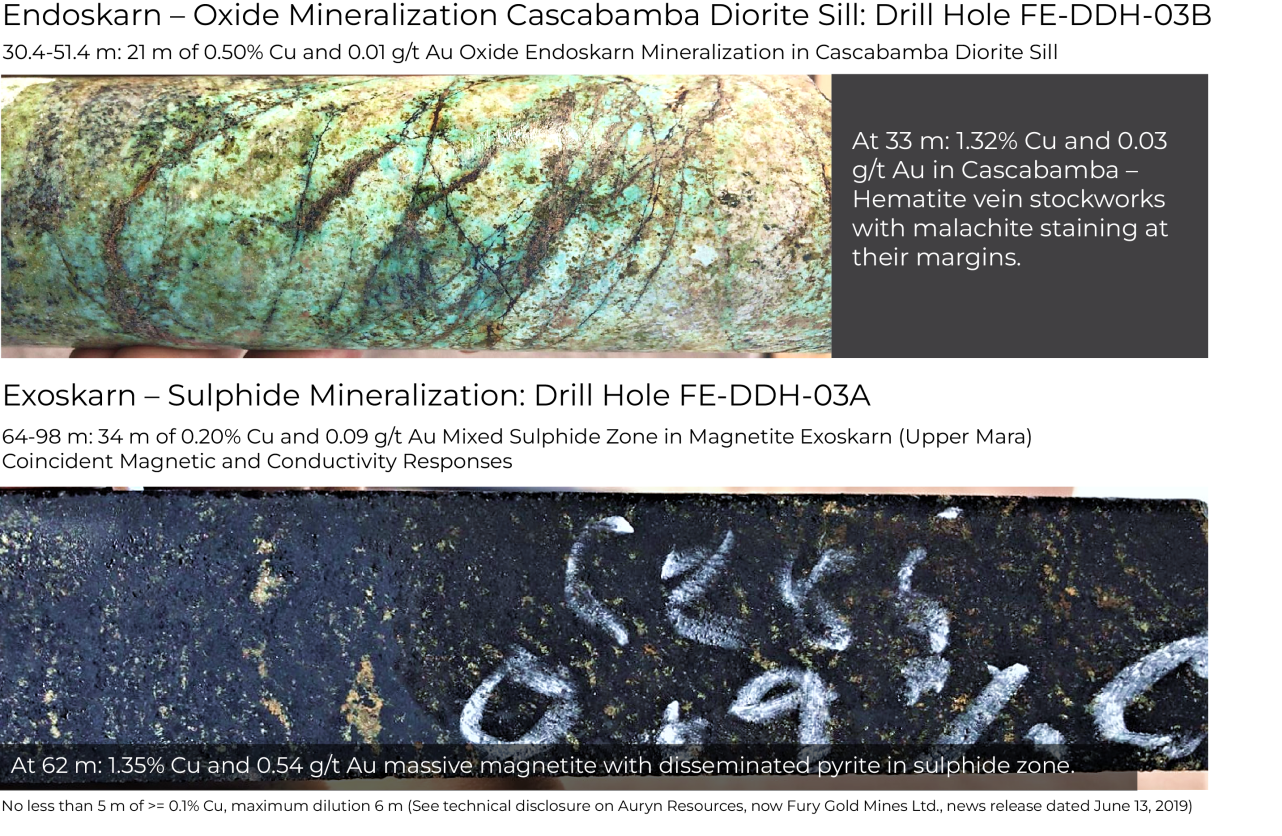

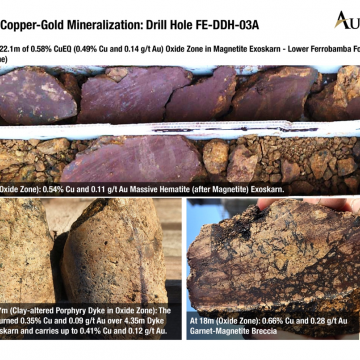

In April 2019, the Company obtained access to core from eight historical drill holes that were drilled in 2013 by a steel company targeting iron skarn mineralization. It assayed the core and results encountered copper-gold mineralization in each hole. Highlights include 116 metres of 0.58% copper equivalent (0.42% Cu and 0.24 g/t Au), 90.4 metres of 0.51% copper equivalent (0.48% Cu and 0.05 g/t Au) and 51 metres of 0.53% copper equivalent (0.43% Cu and 0.16 g/t Au). Collectively, the historical drill holes define a mineralized body totaling 300 metres of strike length with an average width of approximately 150 – 200 metres that is open both to the north and to the south (see June 13, 2019 release).

The results from the historical drill core demonstrate that copper-gold sulphide mineralization extends to depth underneath the previously reported surface channel sample of 232 metres of 0.55% Cu equivalent (see April 3, 2019 release). In addition, the mineralization provides a clear analogue to discover additional large-scale mineralized exoskarn bodies within the Sombrero property, based on similar geophysical and geochemical signatures. Finally, the mineralization encountered in the historical drill holes confirms the Company’s belief that Sombrero has analogous geological and mineralization characteristics of the deposits of the Las Bambas district.Good Lucky Prospect:

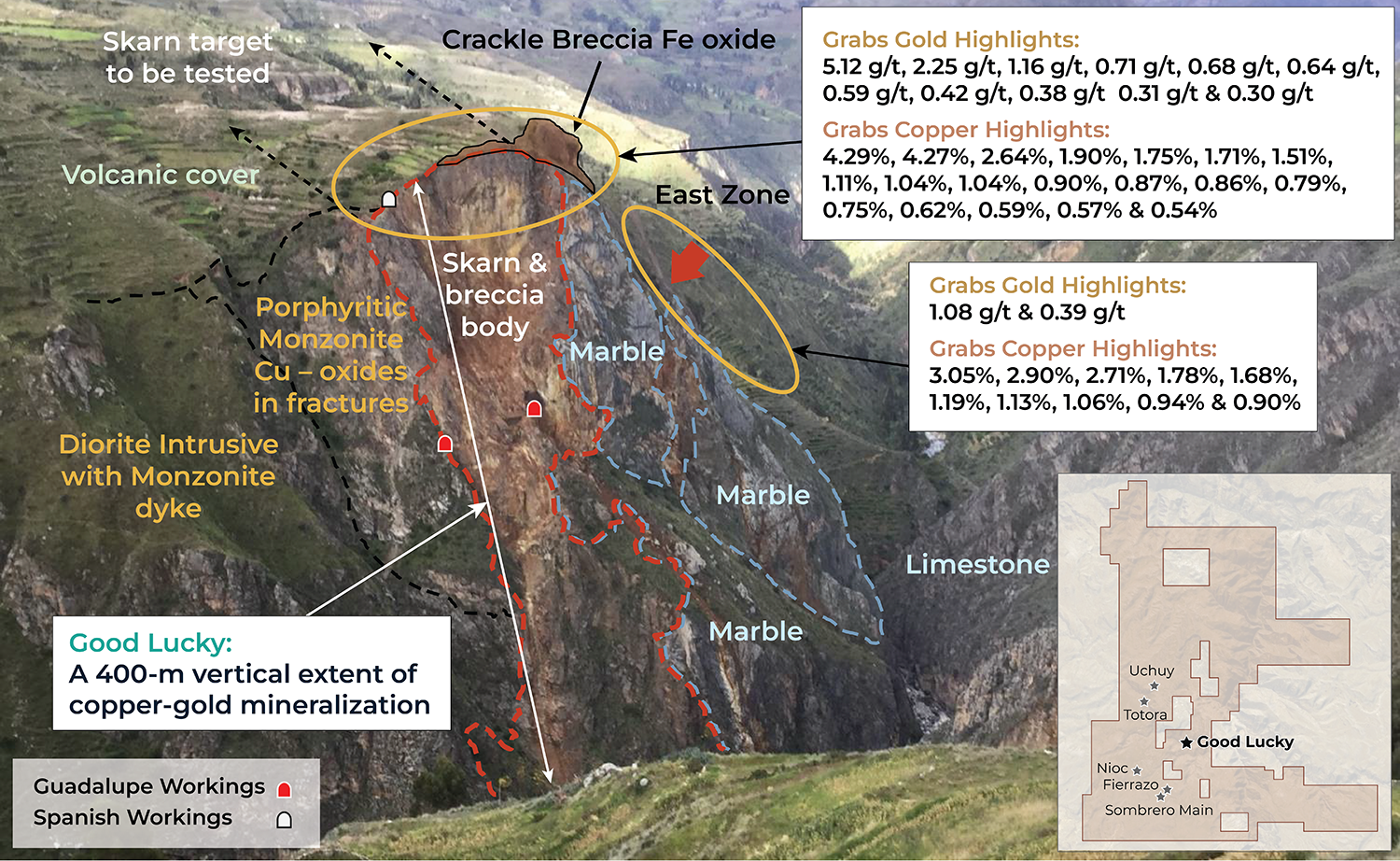

The Mollecruz concessions are approximately 1,000 hectares and represent another cluster of mineralizing intrusive bodies in the Sombrero district that are characterized by copper-gold skarn mineralization. The Mollecruz concessions were acquired in June 2018 and include the Good Lucky prospect. The principal skarn body at the Good Lucky prospect demonstrates high-grade copper-gold mineralization sampled over a 600-metre length and over 250 vertical metres. Rock samples graded up to 5.12 g/t gold and 4.29% copper in sulphide mineralization.

Good Lucky Target: Rock Sample Highlights Additional Prospects:

In addition, two new prospects, Totora and Uchuy, have also been discovered through sampling. At Totora, the Company's geologists have sampled gold values up to 5.07 g/t and copper values up to 3.14%. At Uchuy, strong arsenic and antimony values have been sampled which indicate the potential for proximal base and precious metal mineralization.

Historical surface samples from Sombrero indicate significant copper and gold values. Geological mapping and geochemical sampling were completed over the project in 2007, and high-resolution ground magnetic and induced polarization surveys were completed during 2008. Importantly there has been no drilling that has occurred on the project to date.

-

Ownership

Mollecruz Option

On June 22, 2018, the Company acquired the rights to the Mollecruz concessions located just to the north of Sombrero Main, which is host to the Good Lucky prospect. Under the terms of the Mollecruz Option, the Company may acquire a 100% interest in the concessions by completing US$3.0 million in work expenditures and by making payments totaling US$1.6 million to the underlying owner over a five-year period. At signing, the Company paid US$50,000 and upon exercise of the option, the underlying owner will retain 0.5% NSR royalty with an advance annual royalty payment of US$50,000. Effective May 20, 2019, the Company formally declared the existence of a force majeure event under the Mollecruz Option thereby deferring the Company’s obligation to make the June 2019 and 2020 property payments and any subsequent property payments and work expenditures for a maximum of 24 months from the declaration date. On March 1, 2021, the Company agreed with the owner to extend the force majeure declaration for another 24 months and paid US$50,000 as consideration. As a result, the Company is able to continue deferment of the June 2019 and 2020 property payments and any subsequent property payments and work expenditures until May 20, 2023.

Aceros Option

On December 13, 2018, the Company entered into a series of agreements with Corporacion Aceros Arequipa S.A. (“Aceros”) to acquire the rights to three key inlier mineral concessions, which include Fierrazo and Nioc. If the Aceros Option is fully exercised, a joint venture would be formed in which the Company would hold an 80% interest (Aceros – 20%). The joint venture would combine the 520-hectare Aceros concessions plus 4,600 hectares of the Company’s Sombrero land position. The Company is required to make a series of option payments totalling US$800,000, which includes the US$140,000 paid upon signing, as well as completing US$5.15 million in work expenditures over a five-year period, of which US$0.5 million has been spent to date. The Company has amended the agreement with Aceros to extend the deadlines for the work expenditure requirements dependent on access to the concessions. The option payments are subject to 18% Value Added Tax (IGV) in Peru which is not recoverable.

-

Communities

Programs Funded in the Huanca Sancos Community by Sombrero Resources subsidiary, Sombrero Minerales (SM)

- Australian lamb breeding program:

- $126,000 (SM contribution: $12,000 | Peru Government: $58,000 | Huanca Sancos: $56,000)

- 800 people impacted

- Weaving program for improvement of the production and commercialization of sheep meat:

- $222,000 (SM contribution: $12,000 | Peru Government: $147,000 | Huanca Sancos: $63,000)

- 800 people impacted

- Workshop in the Women's Weavers Civil Association:

- $65,000 (SM contribution: $5,000 | Peru Government: $60,000)

- 210 people impacted

Combined Initial Investment: approx. US$413,000:

Sombrero Minerales: US$29,000

Peru Government: US$265,000

Huanca Sancos: US$119,000 - Australian lamb breeding program:

-

Project News Releases

-

Disclaimer

Sombrero Age Dating, 2019

A total of seven samples of magmatic rocks were collected for U-Pb zircon geochronology analysis. From those, two samples (referred to above as A and B) were sent to Geolab SHRIMP IIe, Institute of Geochemistry – University of Sao Paulo, Brazil. They were analysed through the 'Sensitive High Resolution Ion Microprobe IIe' method, or SHRIMP. The other five samples (C, D, E, F, and G) were sent to CODES Analytical Laboratory, University of Tasmania, Australia, where it was found that only three contained zircon. Those three samples were then analysed with an ASI RESOLution S-155 ablation system with a Coherent Compex Pro 110 Ar-F excimer laser.

¹ Porphyry-Style Alteration and Mineralization of the Middle Eocene to Early Oligocene Andahuaylas-Yauri Belt, Cuzco Region, Peru, Economic Geology, Vol. 98, 2003. Pg 1575-1605

Rocks 2018-2019 (Sombrero, Peru)

Approximately 2-3kg of material was collected for analysis and sent to ALS Lab in Lima, Peru for preparation and analysis. All samples are assayed using 30g nominal weight fire assay with ICP finish (Au-ICP21) and multi-element four acid digest ICP-AES/ICP-MS method (ME-MS61). Where ICP21 results were > 3 g/t Au the assays were repeated with 30g nominal weight fire assay with gravimetric finish (Au-GRA21). Where MS61 results were greater or near 10000 ppm Cu, 10000ppm Pb or 100ppm Ag the assays were repeated with ore grade four acid digest method (Cu-OG62). QA/QC programs for 2018/2019 rock samples using lab duplicates, standards and blanks indicate good accuracy and precision in a large majority of standards assayed. These samples were collected in a non-representative manner. The mineralization may not be reflective of the underlying system.

Channel Sampling 2019 (Sombrero, Peru)

Analytical samples were taken from each 2-meter interval of trench floor resulting in approximately 2-3kg of rock chips material per sample. Collected samples were sent to ALS Lab in Lima, Peru for preparation and analysis. All samples are assayed using 30g nominal weight fire assay with atomic absorption finish (Au-AA25) and multi-element four acid digest ICP-AES/ICP-MS method (ME-MS61). Where MS61 results were greater or near 10,000 ppm Cu, Zn or Pb the assay was repeated with ore grade four acid digest method (OG62). QA/QC programs for 2019 trench grab samples using internal standard and blank samples; field and lab duplicates indicate good overall accuracy and precision.

Intervals were calculated using a minimum of a 0.1% Cu cut-off at beginning and end of the interval and allowing for no more than five consecutive meters of less than 0.1% Cu with a minimum length of the resulting composite of 6m.

Copper and gold equivalent grades (CuEq and AuEq) were calculated using gold price of $1,300/oz and copper price of $3.00/lb.

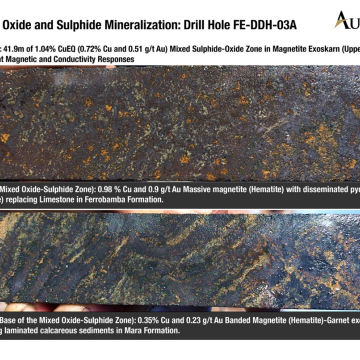

Historical Fierrazo Diamond Drill Hole (DDH) Re-Sampling 2019 (Sombrero)

Sample intervals averaged 2 meters where historical sample intervals taken and otherwise were 2 meters. Where at least half of HQ diameter core was present it was sawed into equal parts on site. Otherwise historical crush rejects were used in lieu of the core. In total 481 quarter core, 20 half core, and 10 crush rejects, approximately 3-5kg each, were sent to ALS Lab in Lima, Peru for preparation and analysis. All samples were assayed using 30g nominal weight fire assay with atomic absorption finish (Au-AA25) and multi-element four acid digest ICP-AES/ICP-MS method (ME-MS61). Where MS61 results were near or greater than 10,000 ppm Cu the assays were repeated with ore grade four acid digest method (OG62). QA/QC programs using internal standard samples, field and lab duplicates and blanks indicate good accuracy and precision in a large majority of standards assayed.

Intervals were calculated using a minimum of a 0.1% Cu cut-off at beginning and end of the interval and allowing for no more than six consecutive meters of less than 0.1% Cu with a minimum length of the resulting composite of 5 meters.

Copper and gold equivalent grades (CuEq and AuEq) were calculated using gold price of US$1,300/oz and copper price of US$3.00/lb.